When you use an ERP system built for manufacturing like Microsoft Dynamics 365 Business Central or Dynamics NAV, your production orders play a crucial role in balancing your general ledger accounts. But how does the costing you put into your production orders affect your bottom line?

To help production managers and finance leaders get on the same page, both parties must understand the cost components of a production order. Doing so minimizes surprises and empowers both sides of the business to communicate effectively within the ERP system.

Not sure how to get started? Read this blog to learn:

- How actual costs post to production orders and then to the general ledger.

- The components of a production order's cost.

- How to finish and post a production order.

How Do Actual Costs Work in a Production Order?

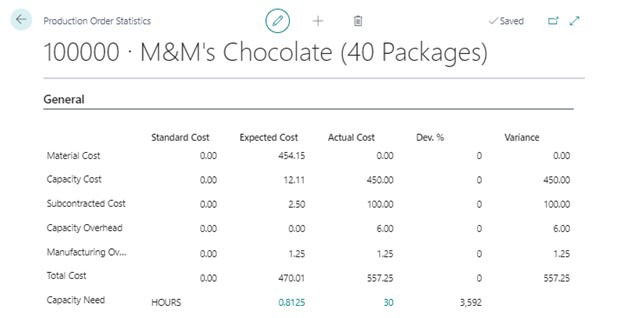

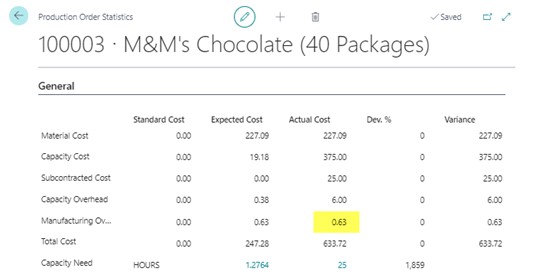

Actual costs are posted to the production order and can be compared to the production order's expected cost to see any variances. You can analyze these variances to determine if there are any issues in the production process. If you use standard cost, any variances will post to the general ledger when the production order finishes.

What Goes into the Cost of a Production Order

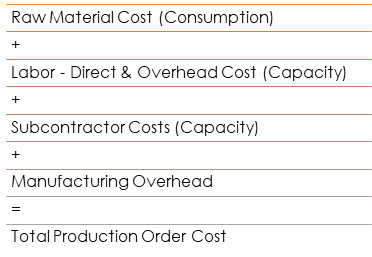

The actual cost of a production order consists of the following components:

Let's review each cost component and how it posts.

Consumption

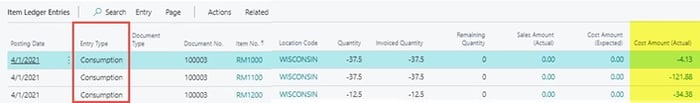

Consumption is posted to a production order from either the consumption or production journal. If you use backward or forward flushing methods, consumption can be automatically posted.

When consumption posts, the following transactions occur:

- Item Ledger Entry: A consumption item ledger entry is posted to remove the raw material from inventory.

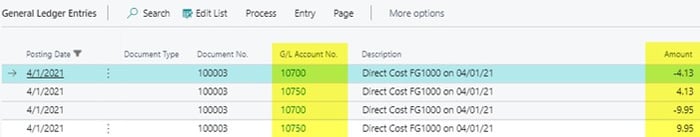

- G/L Entry: A G/L entry is posted. The unit cost utilized is based upon the item's costing method. G/L accounts are selected from the item's inventory posting group setup. The G/L transaction posts to:

Debit WIP

Credit Inventory

Labor (Capacity)

Labor is posted to a production order from either the output or production journal. Expected labor can also post automatically when utilizing backward or forward flushing methods.

When labor is posted, the following transactions occur:

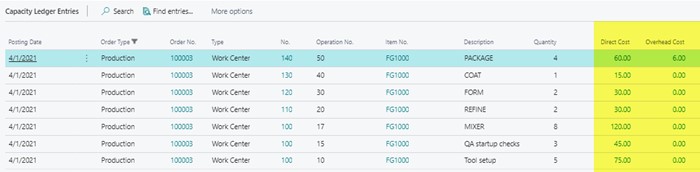

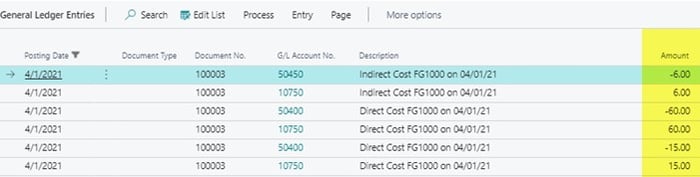

- Capacity Ledger Entry: A capacity ledger entry is posted to accumulate labor time and dollars. Labor can be posted as a direct labor cost or an overhead cost.

- G/L Entry: A G/L entry is posted. The direct unit cost on the work or machine center is used to calculate Direct Cost Applied – Labor. The indirect cost % or overhead rate on the work or machine center is used to calculate Overhead Applied. The G/L accounts used are determined by the work or machine center's Product Posting Group setup. The G/L transaction posts to:

Debit WIP

Credit Direct Cost Applied

Credit Overhead Applied

Subcontracting

When you create a purchase order from the subcontracting worksheet, subcontracting costs are posted to a production order.

When the purchase order is posted as invoiced, the following transactions occur:

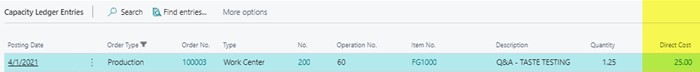

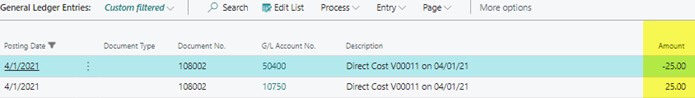

- Capacity Ledger Entry: A capacity ledger entry is posted for the total subcontracting cost.

- G/L Entry: A G/L entry is posted. The direct unit cost on the purchase invoice is used to calculate Direct Cost Applied –Subcontracting. G/L accounts are selected from the work or machine center's Product Posting Group setup. The G/L transaction posts to:

Debit WIP

Credit Direct Cost Applied – Subcontracting

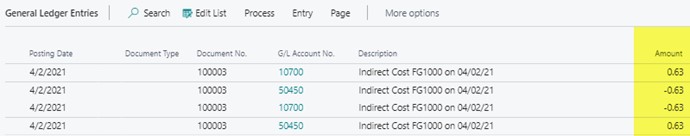

Manufacturing Overhead

Manufacturing Overhead is posted to a production order when an output transaction is posted from either the output or production journal.

When output is posted, the following manufacturing overhead transactions occur:

- Production Order Statistics: The cost is displayed on production order statistics when Output transaction is posted.

- G/L Entry: A G/L entry is posted for production order finishes. The manufacturing overhead is set up on the finished good item card as an Indirect Cost % and/or an Overhead Rate. G/L accounts are selected from the item's inventory posting group setup. The G/L transaction posts to:

Debit Inventory

Credit Overhead Applied

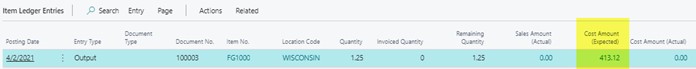

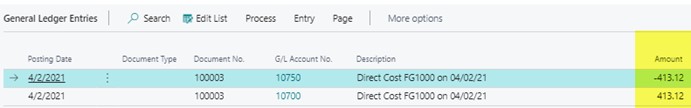

Output

Output is posted to a production order from either the output or production journal.

When an output is posted, the following transactions occur:

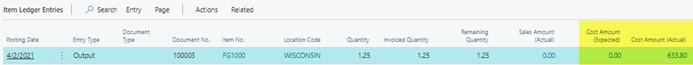

- Item Ledger Entry: An output item ledger entry is posted to add the finished goods item to inventory.

- G/L Entry: A G/L entry is posted only if Expected Cost Posting is turned on. The unit cost from the item card is utilized for the expected output cost. G/L accounts are selected from the item's inventory posting group setup. The G/L transaction posts to:

Debit Inventory - Interim

Credit WIP

Finishing a Production Order

When production output and all cost component transactions are complete, the production order status must change to "Finished" to post "actual" cost for the output transaction and post variances to the G/L if you use standard cost as the costing method.

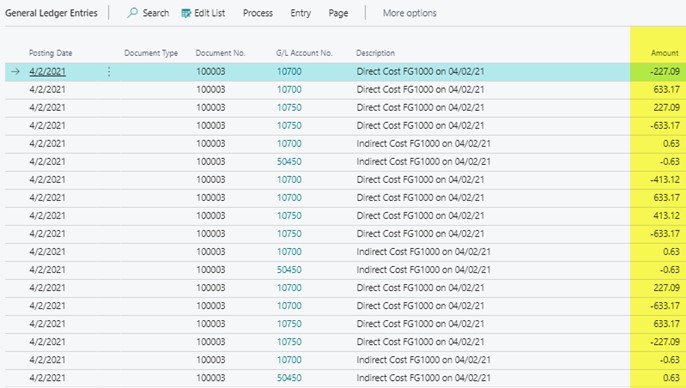

When the output is posted, the following transactions occur:

- Item Ledger Entry: All output item ledger entries for a production order update from expected cost to actual cost.

- G/L Entry: A G/L entry is posted only if Expected Cost Posting is turned on. The expected output cost comes from the item card, and the G/L accounts used are selected from the item's inventory posting group setup. The G/L transaction posts to:

Debit/Credit WIP

Debit/Credit Material Variance

Debit/Credit Capacity Variance

Debit/Credit Cap. Overhead Variance

Debit/Credit Subcontracting Variance

Debit/Credit Mfg. Overhead Variance

Want to See How this Process Works and Ask Your Questions?

Have you been following along but want to follow some practical examples and a step-by-step tutorial? In that case, you'll want to register for the upcoming webinar I will be hosting with my colleague John Grant where we will dive deep into how production order costing works.

(Are you reading this after the webinar? No problem! You can watch on-demand by following the same link above!)

You can also browse our extensive collection of on-demand webinars about manufacturing topics that might interest.