Use Tax is imposed on consumers of tangible personal property that is used, consumed, or stored in the state. Consumer’s use tax applies to purchases from out-of-state vendors that are not required to collect tax on their sales. These rates are commonly the same rate as the sales tax in the area, but be sure to follow your local guidelines as some places do not charge use tax, while others have different rates if a business is collecting both sales and use tax.

The Set Up

In Business Central, there are four key areas to setting up use tax:

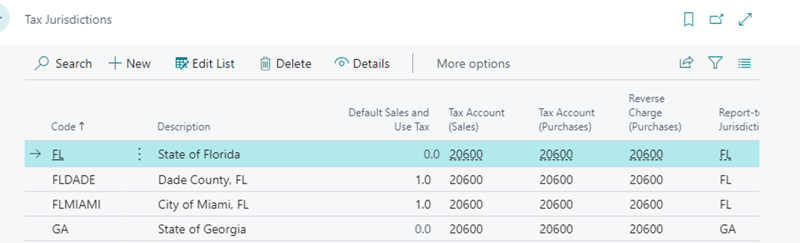

1) Tax Jurisdiction – the who and what (G/L Account). Often these are split into a state, city, county, parish, and special tax districts. The GL account used should be on the balance sheet as a liability. Often companies will separate use tax accrual from a sales tax accrual. For use tax, the expense account (Income Statement Account) will be dictated by the account on the purchase order/invoice.

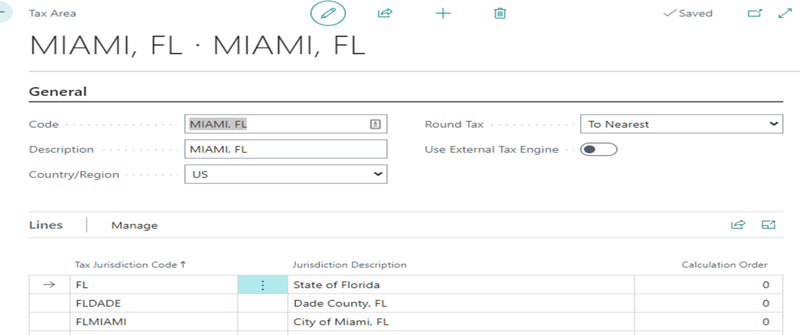

2) Tax Area – combines the tax jurisdictions. This is where you’d add up the state + county + city + special tax and what will appear on the purchase order/invoice.

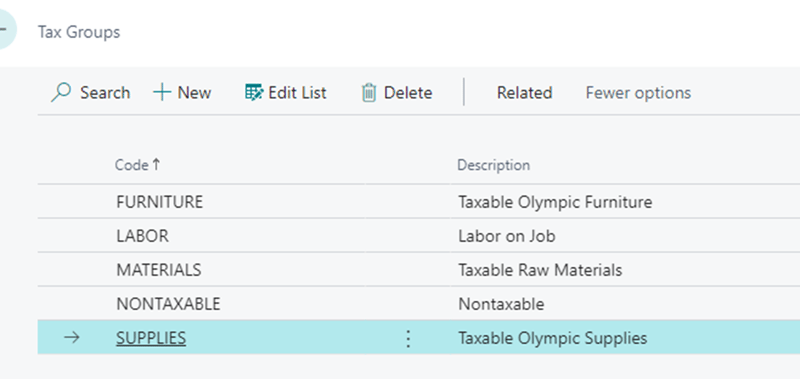

3) Tax Groups – what you sell, for use tax it’s normally set up to something like “Supplies” or another way to identify it from the sales tax values. This is just to enter the header value and description of the item.

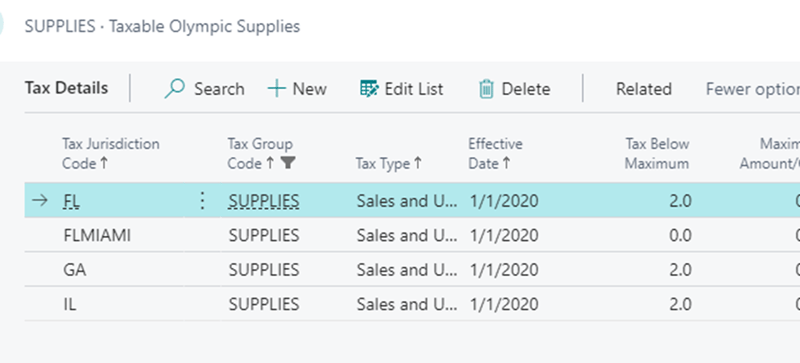

4) Tax Details– where all the previous steps come together to identify the actual tax rates for the transactions. The tax amount to be entered 2% as 2.0 in the Tax Below Maximum field. All states, cities, parishes, counties, and special tax groups should be entered here with their tax amount per line.

Another example for Denver, you would see on the list, CO 2.9, Denver 4.81, and Special 1.10 for a combined rate of 8.81%. Entering an incorrect value on this list would result in under or over-accruals. Multiple years can be kept, and depending on the effective date, the value will update if there’s a timing variance between release and posting.

Schedule a Workshop and Take an In-Depth Dive Into

Sales and Use Tax in Business Central

Using Use Tax

Please be sure to not set up a purchase order for use tax only halfway. It can result in a locking of the purchase order and purchase invoice tables.

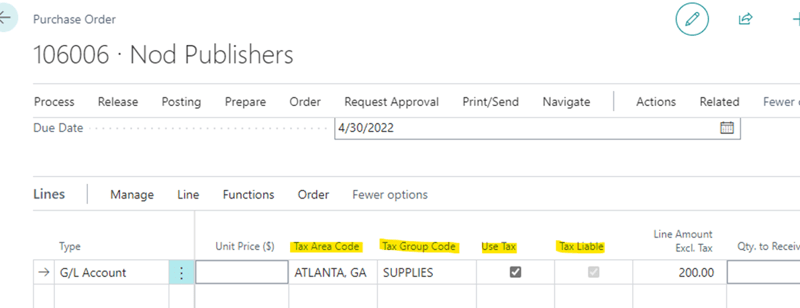

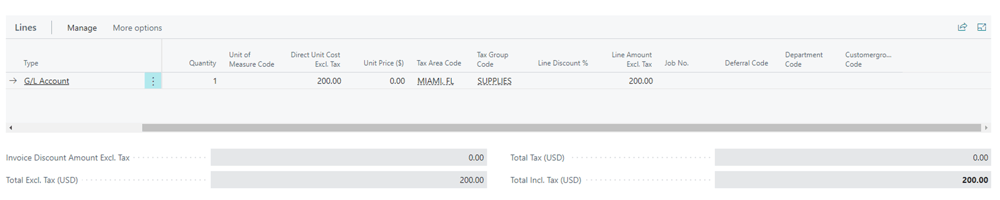

On a purchase order or invoice, under the lines section, fill out the Tax Area Code (the location needing the tax), Tax Group Code (Supplies), and check the Use Tax and Tax Liable boxes if the line item needs use tax applied. Use tax should not be applied if the item is used to make your finished product or the item already has proper sales tax applied.

The tax will trigger on release, post, or statistics. It might not show in the tax section but will show in the statistics.

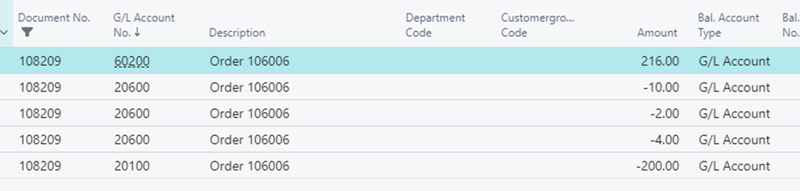

On posting for this example:

- The tax types will separate by type (State, City, County, etc.) and go to the accrual account (20600- $16)

- The expense account (60200) will post the invoice amount and the tax amount ($216)

- The AP account (20100) will post only the $200 to remit to the vendor

If you have any questions about setting up your use tax in Business Central please contact one of our Customer Engagement Specialists, and they can get you the help you need to stay compliant.

Want to Learn More? Watch Our Free Webinar

Managing Use Tax in Business Central