Small and mid-sized businesses can count on Microsoft Dynamics 365 Business Central to house all their business operations—from sales and services to finance and operations.

But, when it comes to managing the order-to-cash cycle, there’s one step that lives outside of the Business Central platform: payment processing.

Without a way to integrate payment processing with Business Central, accounts receivable (AR) is more complicated than it needs to be. With an integrated payments provider, your business’ incoming payments get entered right into Business Central and accurately recorded in your cash receipts journal.

In this blog, we’ll cover:

- The challenges of manual payment processing in Business Central

- 3 wins of integrating payment processing within Business Central

- How RPC reduced overdue accounts by 70% with integrated payment processing

- How Versapay lets you process payments directly in Business Central

4 challenges of manual payment processing in Business Central

When processing payments externally from your financial management system, this creates a lot of manual work for AR teams.

Here are some common issues that Business Central users may encounter if they aren’t making use of integrated payments:

1. Delayed payment processing

Without an integrated payments solution, your team is likely using multiple third-party processors to facilitate a single transaction. This slows down your ability to process payments and makes tracking down important information like bank reconciliation files difficult.

With unique processing requirements for each of your sales channels, you may even be limited in the payment methods you can accept at each touchpoint. With fewer supported payment methods, you could be limiting your potential sales.

With integrated payments, payment data feeds into your financial management system automatically. Without this integration, your AR team has to update customer records manually. This delays your ability to apply payments to open invoices, potentially hindering your ability to make sales if the account holds prevent customers from buying more.

2. High payment processing costs

You might face higher costs for payment processing too. For one, if you need to assign more people to manage manual payment processing, this minimizes your team’s availability to focus on higher-value tasks.

Manual payment processing also deprives your business of significant potential savings from interchange optimization. Interchange optimization is the practice of fine-tuning the conditions of a transaction to qualify for the lowest interchange rates possible. This is done by sending additional data such as invoice line-item details along with each transaction.

Integrating your payment processor with Business Central makes it easy to support Level 3 data processing (the highest level of data you can send to qualify for lower rates) because all that data about the transaction already lives within the platform. Without interchange optimization, your credit card processing fees may be significantly more costly.

3. Highly manual processes resulting in frequent errors

When manually matching and applying payments to invoices, there’s always a chance for human error. Manual data entry is an especially common source of accounting errors.

Not only will your team have to spend time correcting these errors, but these mistakes could result in collections errors. Your collections team could end up reaching out to a customer about a payment that’s already been made or neglecting to follow up on a past-due invoice.

When asked what their greatest concerns with their manual AR processes were, 45% of businesses cited errors, according to a survey from PYMNTS and American Express.

4. Financial reporting complexity

Access to reliable data is essential for AR teams to know which invoices are past-due, which customer contacts need to be updated, and whether their stored payment methods are out of date. These data sources can live both in and out of Business Central, the latter likely managed through spreadsheets. But spreadsheets can only ever show you a moment in time, not a real-time picture of your AR.

Accuracy suffers when payment data has to be updated in your financial management system manually. And that’s a real problem for CFOs. As the owners of the business' financial numbers, CFOs rely on their finance team’s reporting to accurately inform their executive team.

3 wins of integrated payments within Dynamics 365 Business Central

To solve these problems, businesses are looking to extend the capabilities of their financial management system with a payment processing provider that can integrate with their existing platform.

There are integrated payments solutions that cater directly to Business Central users. After integrating their payment processing with Business Central, accounts receivable teams can expect:

1. Fewer manual AR processes

Integrating your payment processing with Business Central can give both your customers and your team a more convenient payment experience. With a solution like Versapay, you can facilitate payments across your eCommerce, point of sale, and accounts receivable channels directly in Microsoft Dynamics 365 Business Central.

Versapay’s integrated payment solution supports click-to-pay invoicing, so customers can pay conveniently online right when they receive their invoice. Those payments will then be automatically posted to the open invoice.

2. Reduced payment processing costs

When you process payments through Versapay, you benefit from interchange optimization. With Level 2 and 3 data processing supported, you can lower your payment processing costs by up to 40%.

You’ll also save on the cost of labor involved with facilitating manual payment processing. Instead of tracking down files from multiple processors, your team members can focus on more strategic initiatives.

3. Stronger payment fraud protection

By processing sensitive payment data through just one system, you also limit the amount of hands that information needs to go through. This helps you protect against payment fraud, as there are fewer entry points for bad actors to potentially access this data through.

With Versapay, you can securely process your online orders from cart to cash using our flexible payment gateway, integrations with popular shopping carts, and competitive merchant services. You can further reduce your risk of fraud with optional checkout features that limit fraudulent chargebacks. All payment data is tokenized and encrypted to give you and your customers peace of mind.

How RPC reduced overdue accounts by 70% with integrated payment processing

The Research and Productivity Council (RPC) provides services that ensure food safety, air quality, and marine health in Eastern Canada and abroad.

They decided to make the switch from manual payment processing to integrating their payment processing within Microsoft Dynamics. Since doing so, they’re now able to send customers auto-generated invoices at the click of the button, which they can then pay through a secure link.

This has resulted in:

- RPC reducing the number of accounts with invoices over 90 days past due by 70%

- Resolving over $600,000 in payments that were previously over 90 days past due

- Eliminating hours spent reconciling payments with their Dynamics instance

Read their full story here.

How Versapay lets you process payments directly in Business Central

Here’s a look at how Versapay’s integrated payment solution for Microsoft Dynamics 365 Business Central helps you accelerate your cash flow with more efficient payment processing.

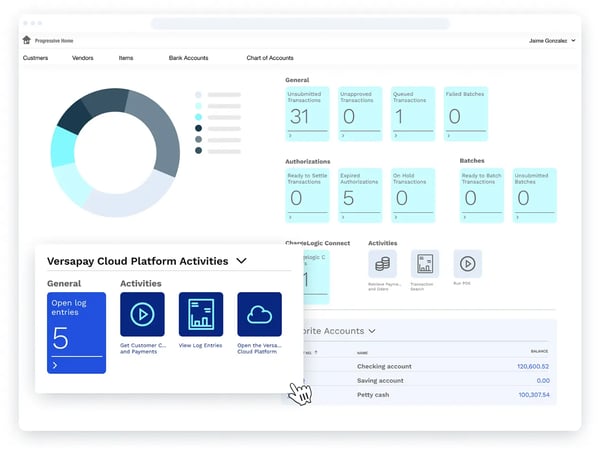

Once you’ve activated the Versapay integration, you can see all your payments that have come in through the platform right from the Role Center in Business Central.

Once you’ve activated the Versapay integration, you can see all your payments that have come in through the platform right from the Role Center in Business Central.

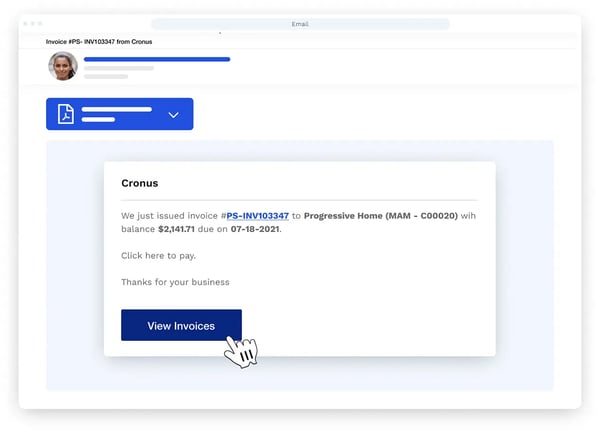

- You can send invoices to your customers’ email containing a button that takes them to a secure page where they can pay the invoice immediately. Customers can pay their invoices without even requiring a log-in. They can pay an individual or multiple invoices in full or customize their payment amount.

When you invoice a customer from Business Central, they’ll automatically receive an email directing them where to pay.

When you invoice a customer from Business Central, they’ll automatically receive an email directing them where to pay.

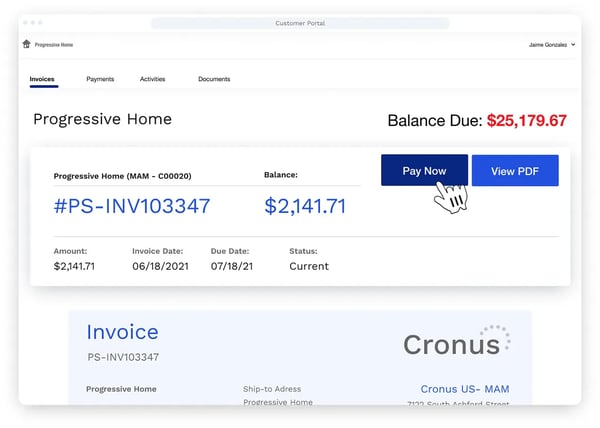

Once they click view invoices, they’ll see the full details of the invoice, can download it for their own records, and make a payment.

Once they click view invoices, they’ll see the full details of the invoice, can download it for their own records, and make a payment.

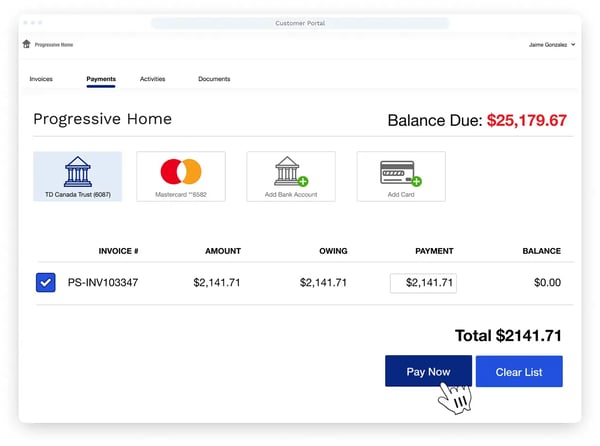

- Customer payments are automatically posted to the cash receipts journal, which can then be posted to the customer ledger. This makes applying those transactions to the appropriate invoices much simpler. With flexible settlement options, you can choose which of your accounts the payments should go to.

-

You can accept credit, debit, ACH, virtual cards, and bank payments across your sales channels. Card refunds can also be handled with ease directly inside Microsoft Dynamics. You can give customers the option to save their payment methods on file—with all card data tokenized and encrypted—to make future payments easy.

When paying an invoice via Versapay, customers have the option to pay by card or bank payment. They can keep multiple accounts on file to keep things easy.

When paying an invoice via Versapay, customers have the option to pay by card or bank payment. They can keep multiple accounts on file to keep things easy.

Learn more about Versapay’s integrated payment solution for Microsoft Dynamics here.